year end accounts extension

We will expect relevant reports to be published in line with the usual timelines see existing timeframes in our statement below. I was just advising the opening poster that due to shortening already the client wont be able to use the online portal for an automatic 3 month covid-19 extension.

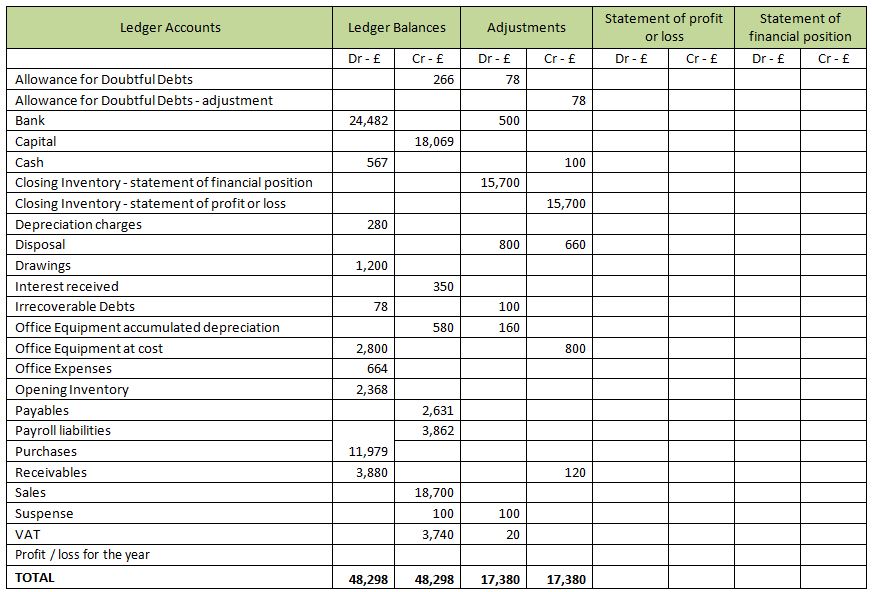

Study Tips How To Successfully Extend A Trial Balance Aat Comment

It is if a client doesnt want to change its year end and end up with future deadlines that do not fall on the last day of the month.

. The company is in. Its purpose is to review the accounting records and financial statements prepared by. A point we both agree on so lets leave it at.

7999-Fee Generation expense account. 1 Accepted a 59009 180-day 6 note from Kelly White in granting a time extension on her past due Dec. The end-of-year financial reports and the link to the.

So if a company is set up on 25th March 2017 it will have a normal year end date of 31st March 2018 and its accounts will be due for filing by 25th December 2018. For more information or help on starting the new year right contact me at mburrowumnedu or Houston County Extension at 507-725-5807 or Fillmore County Extension at 507-765-3896. Under the temporary measures the company received an automatic 3-month extension resulting in a deadline of 31 March 2021.

Yet often they are a last minute affair and proper attention is not accorded the tasks. Review end-of-year checklist for Bookkeeper Review end-of-year checklist for County Program Director Report configurations for MCHCP University Subsidy. 03rd Jul 2020 1101.

Generally companies can lengthen their accounting period to a maximum of 18 months and unless certain criteria apply the financial year can only be lengthened once every 5 years. This means that charities with deadlines from 01 April 2021 onwards will no longer receive additional time and so should again plan to submit within 9 months of a year-end date. This will bring an end to the temporary relief.

May it be because the close of the year is coming or the idea of a fresh start keeps us motivated. This course is designed to highlight the issues both directly related to the year-end close and present information the professional can use to implement a smoother close in accounts. A statement issued jointly by Government and Companies House yesterday March 26 gave detail of the move and coincided with a joint announcement from the Financial Conduct Authority FCA.

Companies may change their year-end by shortening their financial year by a minimum of 1 day as many times as they like. For funds with an annual or half-yearly accounting date after 30 September 2020 the temporary relief will expire and no extra time will be provided. This is a temporary extension of 3 months from the normal filing deadline of 9 months after the year end.

Required reports to the Staff Chair at the County Extension Office in a timely manner giving himher enough time to review and send the. Setting SMART goals gives you focus and direction. The company cannot apply for a further extension as the law only allows a maximum filing period of 12 months.

Companies House has announced a three-month extension to the to the year-end accounts filing deadline in response to the impact of COVID-19 coronavirus. At this time we are either writing the memories of the past year or creating resolutions and plans for the new coming year. Debit Credit General Joumal Date Nov 01 Following are transactions for Vitalo Company Nov.

The new year always bring positive perspective. Temporary extension to company accounts filing deadlines As a result of the COVID-19 emergency HMRC announced that from 27th June companies will have an extension to their statutory accounts filing deadline. Class Code Structure Apply class 4000 to savings and investment bank.

Tennessee Extension Master Gardener Program 2016 Annual Year-End Financial Summary Organized as a separate 501c3. Private companies and LLPs now have 12 months to file their accounts with Companies House. Once finalised by us and approved by our clients we complete the process by submitting these reports to both government departments online as well as our clients for their records.

38 White honored her note when presented for payment. Previously the due date was 6 months after the year end. Reminder on Year-End Compliance.

Revenue Expense Summary. Their deadline for filing accounts would usually be 31 December 2020. The year-end tasks in accounts payable are critical to accurate financial statements for any organization.

Replying to lionofludesch. You have a clear outline of what you want to achieve which tends to result in less stress and quicker outcomes. _____ Year End as of _____.

You can apply to extend your accounts deadline if you cannot send your accounts because of an event thats outside of your control - for. This grace period extended a charitys annual return deadline by an additional 9 months when their deadline date fell between 01 March 2020 and 31 March 2021. Public Limited Companies PLCs now need to file within 9 months.

For other than June 30 year-end fiscal year-end foreign corporations that maintain an office or place of business in the United States the filing deadline is on the 15th day of the 4th month after the end of the foreign corporations tax year additional 6-month automatic extension available upon filing with the IRS of Form 7004. If it shortens its first accounting period to 31st December 2017 then its accounts will still be due for filing by 25th December 2018 as this is later than 3 months after the new accounting period which would. Yes Companies House say that the extension from 9 months to 12 months for a private limited company to file accounts at Companies House applies where the ordinary 9 month deadline would fall on or before 5 April 2021 and on or after 27 June 2020.

The filing deadline is extended if it falls between 27th June 2020 and 5th April 2021 including these dates. The year end accounts often referred to as annual accounts or financial statements for submission to Companies House must be in the approved format. 31 Adjusted the year-end accounts for the accrued interest earned on the White note.

Apply to extend your accounts filing deadline Use this service to apply for more time to file your annual accounts with Companies House. To a maximum of 18 months or longer if your companys in administration once every 5 years You can only lengthen the financial year more often than every 5 years if. NEW employee co-pay or deductible reimbursements.

YesNo If yes name of organization. These end- of-year financial reports are to capture.

Accounts Receivable Turnover Ratio Formula Examples

Understanding Net Worth Ag Decision Maker

Understanding Profitability Ag Decision Maker

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Extension Of Due Date Of Filing Of A Cs To Charity Commissioner Of Maharashtra

Understanding Profitability Ag Decision Maker

Extension Of Due Date Of Filing Of A Cs To Charity Commissioner Of Maharashtra